FREQUENTLY ASKED QUESTIONS

- HOW DO I CHANGE THE NAME OR ADDRESS ON MY PROPERTY TAX BILL?

Please contact the Supervisor of Assessments office to change names or addresses for property tax bill. (618) 382-2332

- HOW DO I APPLY FOR EXEMPTIONS FOR MY PROPERTY TAXES?

Please contact the Supervisor of Assessments office for all questions regarding exemptions.

- WHEN WILL PROPERTY TAXES BECOME DUE?

Property taxes are usually due and payable in two installments and often become due in the fall of each year. Example: Taxes are commonly due in September and November, although this may vary each year. We will post these dates as soon as they become available.

- WHERE CAN I GO TO PAY MY PROPERTY TAXES?

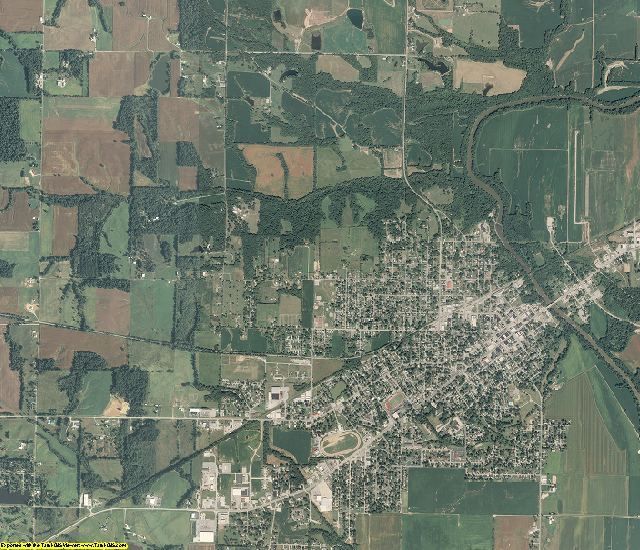

Property taxes can be paid in the office, online, by phone, or by mail. Our office location is 323 E Main Street, Carmi, IL. You can pay online with a debit card, credit card or checking account by clicking the MUNICIPAY link below and researching your parcel. To make a payment by phone, you can call 1-618-266-8211. They can also be mailed to PO Box 369 Carmi, IL 62821. Payments must be postmarked by the due date to avoid penalties or interest. Please include the stubs from the tax bill so we know which parcels they go to.

WE TYPICALLY ACCEPT PERSONAL CHECKS, MONEY ORDERS, CASHIERS CHECKS, CASH, AND DEBIT/CREDIT CARDS.

- WHY DOES MY OIL PROPERTY TAX BILL SAY I OWE $0?

If your bill says you owe $0 then you don’t need to contact anyone or pay anything. Remember, oil is assessed 2 years behind. For example, 2021 production will be payable in 2023. If the oil well does not have enough production to generate a tax bill then the bill will be $0.

- WHAT HAPPENS IF I DON’T PAY MY TAXES ON TIME?

If you don’t pay your taxes on time, your property will go to TAX SALE and you could be subject to additional penalties, costs, and interest. After so many years of non-payment you could potentially lose your property.

- WHERE DOES THE PROPERTY TAX DOLLARS GO?

Your property tax bill will show in detail what taxing bodies are in your district. Select the link below for a county summary for the 2023 Payable 2024 tax cycle.